Oil and Gas

[Oil and Gas photos can be in this section]

General

The oil and gas industry is a capital-intensive industry with assets ranging from wells, risers, drilling rigs, and offshore platforms in the upstream segment, to pipelines, liquefied natural gas (LNG) terminals, and refineries in the midstream and downstream segments. Corrosion has been a major cost in the operation of oil and gas facilities; hence, most oil and gas companies have some sort of corrosion control or management program, the level of which depends on size, geographic location and culture of the companies. In order to capture the differences across the oil and gas industry, corrosion management practices for international, national, intermediate, and unconventional oil and gas companies were examined.

Any oil and gas asset that is susceptible to corrosion should have a corrosion management program to protect against the consequences of corrosion. However, in many cases the CMS is limited to corrosion engineering and corrosion control practices without the management system components. This lack of a true CMS can lead to increased risk of failure and reduced asset life due to corrosion, leading to:

Decreased safety and increased environmental exposure.

Higher chemical treatment, repair, and inspection.

Increased number and duration of unplanned shutdowns.

Lack of corrosion management can also lead to an inefficient use of resources because corrosion control activities are not adequately prioritized on the basis of ROI (all costs including direct financial and safety and environmental risk). For example, a sound technical corrosion control solution might not be implemented because (i) a positive ROI does not exist or (ii) a positive ROI exists but is not communicated. When a technical solution has both a positive ROI and is justified by ROI, then the technical solution can be evaluated on equal terms to other proposed projects being considered for funding. In all cases, a robust CMS is the driver for realizing/maximizing ROI from corrosion mitigation activities.

In the oil and gas industry, the development and implementation of corrosion management varies greatly across the industry and across global regions, as is demonstrated by the survey results.

Benchmarking survey results shows that four groups exist across the oil and gas industry with practices ranging from no corrosion management in place to having a mature corrosion management program that is an integral part of an organization’s overall management system.

Whereas most surveyed oil and gas industry organizations claim to have a corrosion management policy, corrosion management policy and implementation differed significantly among organizations and even among a single organization’s operating geographies. When there are significant policy differences within the same company, this would indicate that the corrosion management policy is not truly integrated into the organization’s policy at the highest level, either deliberately or by omission.

Differences in corrosion management practices within the oil and gas industry could be caused by several factors, including the following:

- The scope of the organization; i.e., international oil companies vs. national oil companies, intermediate companies, and unconventional oil companies.

- Strategic national interests.

- The differences in corporate philosophy, culture, and risk tolerance.

- The effect of local regulation.

- Offshore vs. onshore and geographic location; e.g., operation in the Gulf of Mexico vs. the North Sea, Africa, and the Far East, etc.

- Financial position (cash flow/capital availability).

In the following sections, the corrosion management practices for international oil companies, national oil companies, intermediate oil companies, and unconventional oil companies, respectively, are discussed. These discussions are based on document review, discussions with company SMEs, and industry focus groups with additional input from the survey results.

Appendix D includes a case study of a national oil company that is in the process of implementing a CMS.

International Oil Companies

International oil companies (IOCs) can be defined as oil companies that are vertically integrated, operate outside of their home country, and are predominantly publicly owned. The IOCs characteristically operate in many countries, and are accordingly “international.” The five or six largest companies that belong to this group of so-called “super majors” include Chevron, Exxon Mobil, Royal Dutch Shell, BP, Total, and ConocoPhillips. Ranked by volume of oil and gas reserves, only six of the top 20 upstream companies are IOCs; the remaining are national oil companies (NOCs). The IOCs are working in increasingly challenging environments where corrosion is one of the major threats to the integrity of their assets. With increasing water cut, increasingly high concentration of corrosive gases, and higher temperatures and pressures, internal corrosion has become a major threat to asset integrity. Hence all IOCs have a corrosion control program to mitigate the effects of both internal and external corrosion.

While the IOCs all practice corrosion control, the level of corrosion management greatly differs depending on management culture, risk tolerance, and project portfolio. The benchmarking of IOCs indeed suggests significant differences in management approach, and further in-depth examination of selected IOCs highlights some significant differences in corrosion management practices.

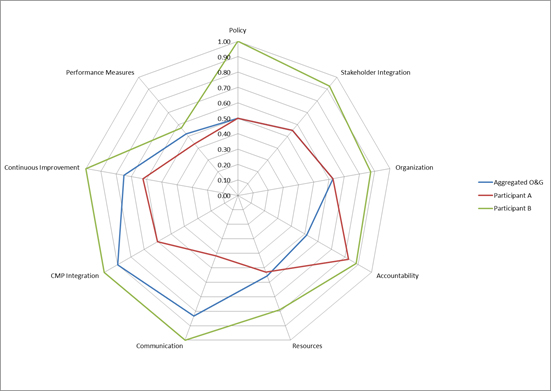

A comparison between two major IOCs and the aggregated oil and gas scores (all companies), shown in Figure 5-1, reveals different scoring, indicating different corrosion management approaches. Company A’s survey results suggest that corrosion management is mostly regionalized. For example, in one region where regulation is strong, corrosion management has been developed and implemented, whereas in other regions with weak regulations, corrosion management is limited to the task of corrosion control, and only to the extent of meeting minimum local requirements. Company B, on the other hand, reports a strong centralized corrosion management program that is intended to be equally implemented to all parts of the organization including all regions. However, even with a strong centralized corrosion management program, it often turns out to be difficult to roll out and implement the program to different parts and regions of the company, often because of differences in operating practices and culture. Company B considers itself the closest to “best practices.”

Figure 5-1. Benchmarking of two IOCs against aggregate oil and gas scoring.

The conclusions from the surveys were confirmed by SMEs having experience with the surveyed companies.

National Oil Companies

Although there is confusion on how to define NOCs, a common definition is that they are predominantly owned and controlled by a single national government. Other aspects of NOCs are (i) the company has or does not have privileged access to resources in its home country and (ii) the company is or is not transparent and reports performance in accordance with regulatory requirements (e.g., U.S. Securities and Exchange Commission requirements). There can be a separation between state ownership and state control, where the government retains a minority “golden share” with substantial approval or veto rights.

Some NOCs have begun operating as multinationals, so the distinction between “national” and “international” companies has become less clear. Another way to think of the conventional NOC and IOC definitions is therefore “nation-owned oil companies” and “investor-owned oil companies,” respectively. The NOCs are a hard group to define, in part because they appear in developed/centrally planned and developing countries alike. Some companies, such as Statoil, have shifted between the NOC and IOC definitions over time. They tend to have close relationships with the government of the country in which they are based, but they range from wholly controlled by the government to power centers in their own right independent of changes in a current government. For the purpose of this report, some regional oil companies that predominantly operate within a country are included in discussions with NOCs.

Finally, a number of auxiliary businesses are often associated with NOCs, including electric power generation, chemicals, minerals, and all manner of infrastructure, with some having far-flung interests in non-energy retail and commercial assets. For example, an NOC in Asia operates general grocery stores because such outlets happen to be the channel through which petroleum products are distributed in that country.

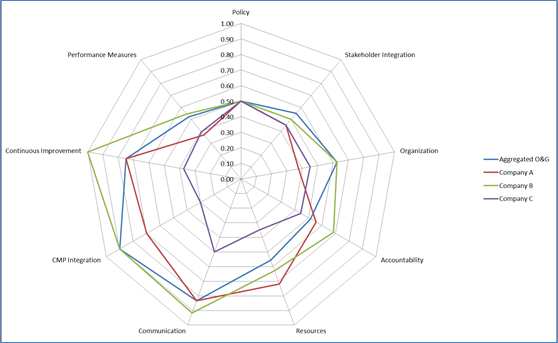

Figure 5-2. Benchmarking of Middle East (A), Asian (B) and South American (C) NOC against aggregate oil and gas scoring.

The results of the survey of three NOCs in the Middle East (A), Asia (B), and South America (C), along with the aggregate oil and gas results, are shown in Figure 5-2.

Companies A and B show similar trends in the aggregated results, where the low scores are for the elements Performance Measures, Policy, Stakeholder Integration, Organization, and Accountability. Again, the low scores suggest little commitment from management to a corrosion management program (i.e., low policy scores), and no follow-up practice as indicated by the low key performance scores.

Further examination of the companies’ corrosion management practice explained some of the findings from the surveys. Without clear commitment by management to some form of corrosion management, other elements regardless of scoring are not optimized. Even with the full backing of management, effective corrosion management often does not materialize.

For example, a Middle East NOC has received the commitment of management to develop and implement a corrosion management framework. With this commitment, the company has developed a detailed and well thought-out corrosion management approach and implementation plan. However, implementation of the plan has many obstacles. The company intends to implement its CMP in two ways:

- Corrosion management for existing facilities, where the stakeholders often do not understand the requirement or don’t see the need to implement such a program.

- Corrosion management for new construction, where the company requires the engineering firms to include a CMP in their front end engineering design (FEED) reports. While the engineering firms try to comply with these requirements, they often don’t have the right competency and hence don’t know how to handle the requirements.

In this case, the link between having a CMP and implementing the plan is missing. Therefore before rolling out the plan, the company should invest time in educating its own staff in the field as well as contractors on the use of the plan and instill in them the importance of buying into the plan.

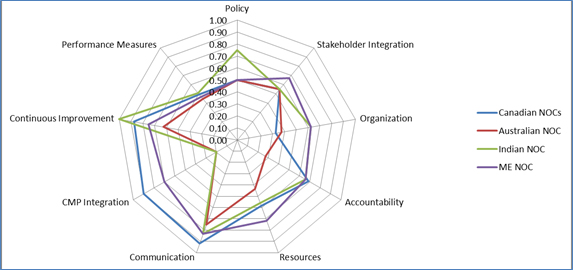

Figure 5-3 shows a different look of the survey results, where responses of NOCs and regional oil companies (Canada and Australia) from four different geographic regions are shown. These geographically diverse groups show similar trends for performance measures (although relatively low scores), stakeholder integration, and communication (relatively high scores). A wide scatter in results occurred for CMP integration and continuous improvement. Significant overall trends were not observed, although Middle East and Canadian oil companies trended closer than did any other combination of geographical regions.

Figure 5-3. Benchmarking of NOCs and regional oil companies from four different geographic regions.

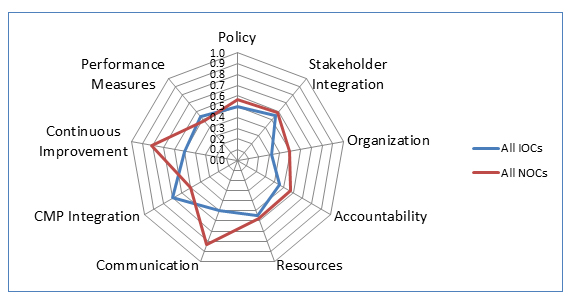

Figure 5-4. Benchmarking of all IOCs and NOCs that responded to the survey.

When comparing all IOCs with all NOCs that responded to the survey, the resulting radar diagram in Figure 5-4 shows similar trends, with continuous improvement and communication having the most variation.